Since the adoption of the system in Canada and Switzerland, the ‘Carbon Fee and Dividend’ system has gained increased interest worldwide as a cross-sector and socially just approach to reducing emissions and tackling climate change

.

Later this month in Exeter, the Positive Money group will be looking at a new take on how to finance the tackling of climate change:

Talk – “Carbon Fee and Dividend”

.

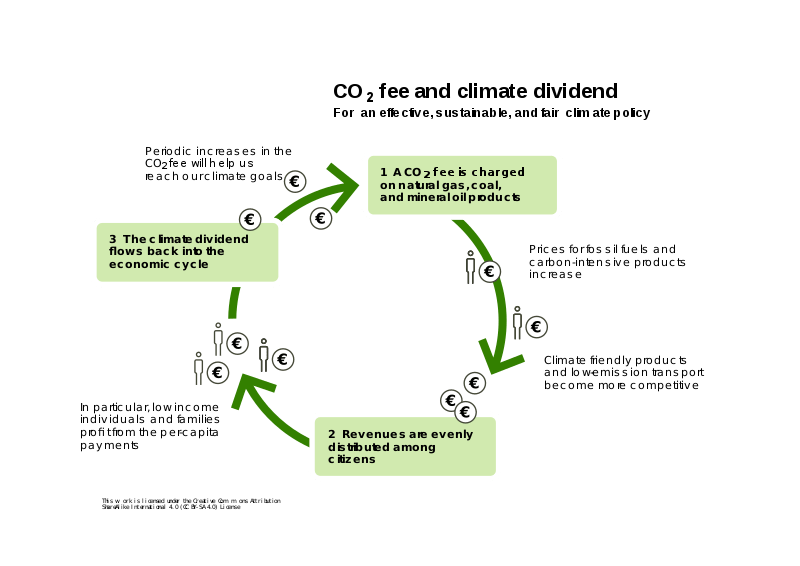

This is how it works:

.

A carbon fee and dividend or climate income is a system to reduce greenhouse gas emissions and address global warming. The system imposes a carbon tax on the sale of fossil fuels, and then distributes the revenue of this tax over the entire population (equally, on a per-person basis) as a monthly income or regular payment.

Since the adoption of the system in Canada and Switzerland, it has gained increased interest worldwide as a cross-sector and socially just approach to reducing emissions and tackling climate change.[1][2][3][4]

Designed to maintain or improve economic vitality while speeding the transition to a sustainable energy economy, carbon fee and dividend has been proposed as an alternative to emission reduction mechanisms such as complex regulatory approaches, cap and trade or a straightforward carbon tax. While there is general agreement among scientists[5][6] and economists[7][8][9][10][11] on the need for a carbon tax, economists are generally neutral on specific uses for the revenue, though there tends to be more support than opposition for returning the revenue as a dividend to taxpayers.[12]

Carbon fee and dividend | en.wikipedia.org

.

With more from Canada, where it’s been in operation:

Carbon Fee and Dividend – Best for Lower and Middle Income | below2c.org

.

Plus a couple of interesting pieces:

The Basics of Carbon Fee and Dividend | citizensclimatelobby.org

Exxon is lobbying for a carbon tax. There is, obviously, a catch. | vox.com

.

Climate Income (or Carbon Tax & Dividend) Explained | citizensclimatelobby.uk