No plans as yet for a ‘meat tax’ – but support for ‘sugar and salt taxes’.

.

What behaviours should be encouraged/discouraged by government – if at all? The debate over what people should be eating suggests that taxing fatty foods could help tackle the climate crisis and that HFSS [high in fat, sugar and salt] laws have failed to inspire change in consumers – which might mean that ‘tougher taxed might be needed’ – so says the retail industry.

Meanwhile, away from the science, the practicalities and feasibility of such policies, there is the politics.

A MEAT TAX?

There were calls last month for an “honest” debate over the cost of net zero – largely because claims made the PM on “scrapping a meat tax, bin rules and car sharing” was not all it seemed:

Rishi Sunak vowed this afternoon that his government would “never impose unnecessary and heavy handed measures” on the public via green policies. And to listen to the Prime Minister, you’d be forgiven for thinking draconian new eco-laws were just moments from coming into force, slapping Brits with higher costs on everything from KFC to Uber. Sunak said he had scrapped the “proposal to make you change your diet – and harm British farmers – by taxing meat”. Hearing this, one could imagine that the humble rump steak would soon be whacked with extra green taxes. But this is not the case.

Some campaigners have called for lower meat consumption, and the government’s own committee on climate change has warned that it will be difficult to hit certain targets in the long-term unless there is a sea change in how we consume meat. But plans for a meat tax or similar green policies have never been raised by the government publicly, nor have they featured in any consultation. One ‘nudge unit’ document suggested it as an idea in 2021, but there is no evidence of the government ever pursuing the policy in any form. ‘Was it actually going to happen’ rating? 0/10.

The Committee on Climate Change has indeed just called for a cap on vegan food to ‘guilt’ people into eating less meat. And the beef industry has criticised the CCC for calling for a sharp drop in meat consumption and livestock numbers – and yet the CCC has not called for a ‘meat tax’ per se:

The influential independent committee used its report on criticise what they see as a lack of progress across all the UK’s governments on climate change and it felt ‘markedly’ less confident than a year ago that targets would be reached in cutting carbon emissions. The report does not just cover meat consumption, but also criticises the UK government for lack of progress on a range of topics, including coal power stations, air travel and heating in homes. The 438-page report welcomed falling livestock numbers across the UK but noted this was despite ‘no policy support in this area to support the current momentum in the right direction’. Then went to to call for further government intervention to push people to eat less meat.

But it’s not just the ‘influential’ CCC which has been calling for less meat consumption. Two years ago, the government’s own National Food Strategy proposed to introduce salt tax, reformulate the sugar tax and cut down on animal protein:

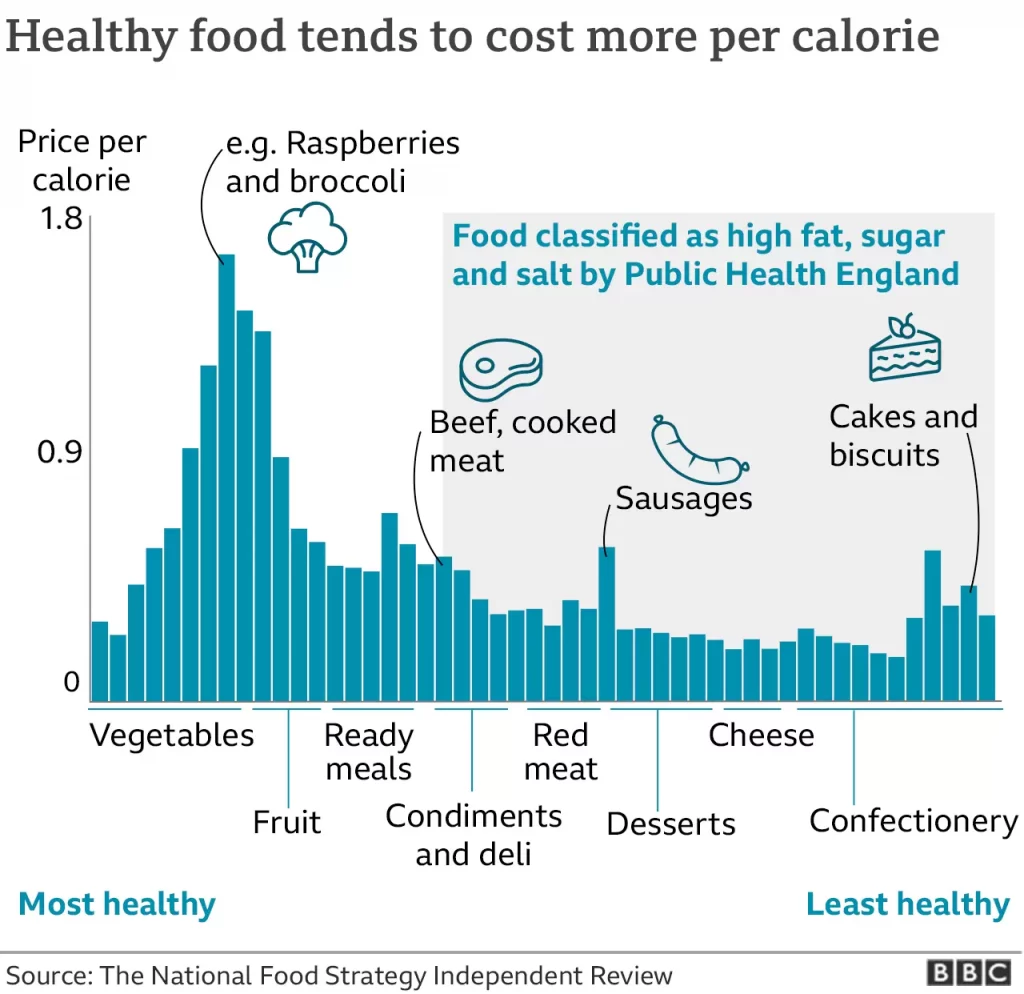

The millionaire founder of restaurant chain Leon, Henry Dimbleby, has been tasked by Boris Johnson to make recommendations on the reduction of fat, sugar, salt and red meat consumption as part of the Government’s National Food Strategy. In a bid to get the nation healthy and combat the climate crisis, or as stated in the report “escape the junk food cycle and protect the NHS”, the Food Strategy has made a number of propositions, including adding a levy of £6 per kilo of salt and £3 per kilo of sugar whilst using public funds to help low income families to access fresh fruit and vegetables.

Whilst the proposal doesn’t set out to introduce a meat tax – a move which would have proved unpopular with meat producers and consumers – it pledges £50 million to be used to build shared facilities for the development of alternative proteins, to help start-ups and scientists develop non animal derived produce.

Some researchers are indeed asking if there would be support for a tax on meat to encourage environmentally sustainable behaviours. And others are suggesting that whilst no UK politician is calling for a meat tax, maybe they should:

No prominent UK politician has proposed taxing meat, despite government ministers insinuating it is Labour party policy. Levels of meat consumption are a problem though. And while Conservative MPs might assume it’s a proposition the public would baulk at, research on the feasibility of meat taxes isn’t so clear-cut. Eating large quantities of red and especially processed meat is unhealthy and increases your risk of developing a number of diseases. Public sentiment overwhelmingly condemns the intensive animal farming practices that generate cheap meat products – even if that concern does not always translate into fewer purchases (researchers have dubbed this the “meat paradox”).

Livestock farming contributes to numerous environmental problems, from deforestation and biodiversity loss to pollution and climate change. But when a meat tax is suggested to stem these problems, by reducing meat demand and financing more sustainable alternatives, such a policy tends to be interpreted as an assault on consumer freedoms or hard working taxpayers. In new research, we investigated two claims that are often made in the political debate: that a meat tax necessarily harms low-income households and that introducing one is politically impossible. We found that neither stands up to scrutiny.

A SUGAR TAX?

The bigger question is whether taxation should encourage/discourage certain behaviours.

Back in 2018, the government brought in its Soft Drinks Industry Levy – to “help to reduce sugar in soft drinks and tackle childhood obesity”. Five years on, and it has been shown that more than 45,000 tonnes of sugar has been removed from soft drinks and the sugary drinks tax may have prevented over 5,000 cases of obesity.

The government was urged to go further, with the National Obesity Forum in 2020 calling for the sugar tax to be extended to make the crackdown on junk food work:

A refusal to slap a sugar tax on more fattening products will fatally undermine a new crackdown on junk food, Boris Johnson has been warned. The prime minister – who once vowed to fight any curbs on unhealthy foods – is now set to propose a ban on advertising them online and before the watershed at 9pm. The package, to be unveiled as early as next week, will also push for calorie counts on restaurant and takeaway menus, with labels to identify products that are high in sugar.

But the National Obesity Forum has accused him of ignoring the warnings of his own health chiefs that obesity is “a national emergency” – and that an extension of the sugar tax is needed. Tam Fry, the group’s chairman, said the existing levy on drinks, introduced in April 2018, had been “extremely successful”, driving down the sugar consumed by about 28 per cent.

And, returning to the National Food Strategy, in 2021 there were calls for a £3bn sugar and salt tax to improve the UK’s diet. The Mail is now supporting the push by campaign group Recipe for Change for a salt and sugar tax, which would “tackle the UK’s bulging waistline and prevent 2MILLION heart disease, cancer and diabetes cases“:

The UK needs a new tax on salt and sugar to win the battle against obesity, heart disease, diabetes and cancer, a campaign group has said. The move would prevent 2million preventable cases of the diseases over the next 25 years, according to a coalition of health bodies. It would also slash the number of obese Brits by a tenth and raise £3billion a year, which should fund healthy eating programmes, Recipe for Change said.

Recipe for Change, a coalition of health charities that has the backing of the Royal College of Paediatrics and Child Health and Royal Society for Public Health, made the call in a report. They hope to pressure the Government to go further on tackling obesity — an issue which costs the NHS an estimated £6.5billion each year. In their report the coalition suggest two options for salt and sugar levies. One is a flat charge of £3 per kg of sugar and £6kg of salt in foods, with an exception being made for pure versions of these ingredients to avoid taxing home cooks. Such measures were proposed by former Government food adviser and co-founder of the Leon restaurant chain Henry Dimbleby to help combat Britain’s obesity crisis. But he resigned from his role in March this year, citing a lack of appetite within Government for necessary changes.

…